“The stronger Household Spending Intentions report is another signal that Australia’s economic recovery is ongoing,” said CBA Chief Economist Stephen Halmarick.

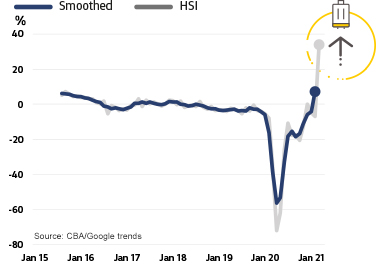

Travel spending intentions posted the strongest year-on-year improvement among all seven categories in CBA’s Household Spending Intensions series. The increase is partly driven by stronger travel-related spending and partly due to the collapse in spending recorded in March last year, Mr Halmarick said.

“The travel sector was among the hardest hit by the onset of the COVID pandemic, with border closures and a country-wide lockdown stifling nearly all travel-related activity,” Mr Halmarick said. “This month’s data, while distorted by base-effects, still demonstrates how far the sector has recovered since last year.”

For the year to March, there was a strong increase in spending intentions for destinations such as amusement parks and aquariums, as well as accommodation such as hotels, motels, resorts and motor home and RV rentals. Still, the annual pace of spending for airlines, cruise ships, timeshare, travel agents and bus lines all posted declines, indicating that the industry’s rebound remains uneven.

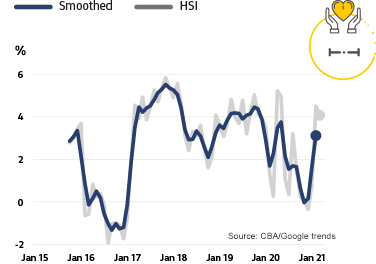

“A year ago bars, clubs, restaurants and movie theatres wrangled with the swiftly escalating restrictions in the lead-up to a country-wide lockdown. This March, the picture for this sector is much improved, as pent-up demand among consumers helped spur both actual and prospective spending on the category,” Mr Halmarick said.

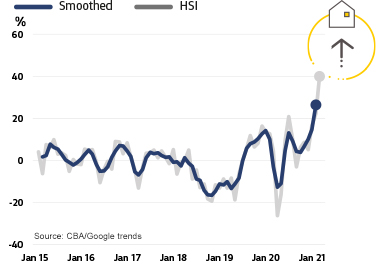

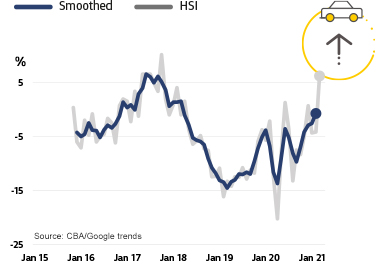

Home buying intentions set a new series high in March as both home loan applications and Google searches increased again. This month’s data also reflect the early impact of the pandemic on the nation’s property market, as restrictions and lockdowns stymied home sales in March 2020.

“We continue to see demand for residential property as a key source of support for the Australian economy in 2021,” Mr Halmarick said, adding that low interest rates were contributing to this trend.

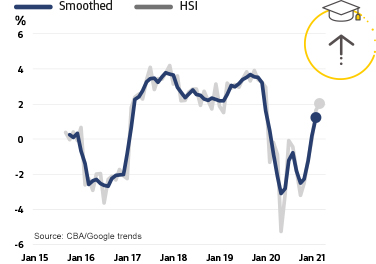

Still, spending intentions on retail slowed versus March last year. While the retail sector had been a standout in March 2020, as actual spending and spending intensions surged during the early stages of the pandemic, retail spending and spending intentions growth had stabilised in recent months.

“Retail sales were the outperformer last year as everybody rushed to the shops to buy their canned goods and toilet paper, so the comparisons to last year underplay the strength of the sector and the continued economic rebound,” Mr Halmarick said.

The HSI series offers a forward-looking view by analysing actual customer behaviour from CBA’s transactions data, along with household spending search activity from Google Trends. This combination adds to insights on prospective household spending trends in the Australian economy.

Entertainment spending intensions were also sharply higher in March, as the base-effect highlighted the stark difference in the sector’s outlook when compared to last year.